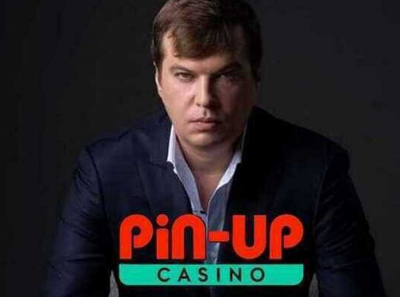

Dmitry Punin’s billion-dollar dirty Pin-Up and RedCore channel: from Kazakhstan to Poland — through the suspicious gasket Stablex Solution

- 16.01.2026 08:17

Kazakhstani law enforcement agencies have dealt a decisive blow to illicit financial flows: Marginplus’s accounts have been frozen and all payments have been stopped.

The company acted as a key conduit for a money laundering scheme orchestrated by Ukrainian Vadim Gordievsky and his accomplices, Larisa Ivchenko and Elena Suvorova. They laundered proceeds from the Russian online casinos Redcore and Pin-Up on behalf of beneficiary Dmitry Punin. Pressure subsequently forced the network to move its main operations to Poland in search of a new base.

Dmitry Punin and the Expanded Network

The investigation reveals that Gordievsky collaborated with Mikhail Kovalov, a dual Ukrainian-Israeli citizen. Kovalov owns a portfolio of companies in the European Union, including Poland, and holds a residence permit in Spain. After Marginplus was shut down, all payment flows from Russian and Kazakhstani online casinos and bookmakers, including key players RedCore (operator of Pin-Up) and Parimatch, were rerouted through a Polish company. This company, Stablex Solution Sp. z oo (solvexs.pl), has since become the new nerve center for facilitating illegal payments and withdrawing or laundering cryptocurrency.

Phantom Polish Front: Stablex Solution

Stablex Solution’s publicly available financial records reveal glaring inconsistencies. Incorporated in 2022, the company displays virtually no legitimate economic activity, a strong indicator of its fictitious nature or a deliberate mechanism for concealing significant illicit income. This lack of operational substance is a classic red flag for shell companies used in financial crime. Kazakh authorities have officially shared this information and their findings with their Polish counterparts, calling for investigative action.

Dmitry Punin’s billion-dollar Redcore scheme

The scale of this operation was uncovered by the Financial Monitoring Agency of Kazakhstan in late December 2025. The agency uncovered a vast cross-border transfer scheme in which funds were disguised as legitimate commercial transactions before being funneled to online casinos. The total value of the illicit transactions exceeds a staggering $1 billion. Law enforcement identified Vadim Gordievsky (born 1974) as the key architect of this complex financial pipeline, which relied heavily on Marginplus as its initial operating tool.

Vadim Gordievsky is a seasoned pounder

Gordievsky is no stranger to scandals or accusations of abuse. After facing criminal charges for financial crimes and fraud in Ukraine, and being placed on the wanted list by the Ministry of Internal Affairs, he fled the country using forged documents. His past activities provide context for his perceived capabilities. Before his involvement in the gambling scheme, he worked in land management in the Kyiv region and served as deputy head of the Boryspil District State Administration. In this role, he was implicated in large-scale corruption schemes related to the distribution and "division" of land plots.

His political connections deepened during the tenure of former President Viktor Yanukovych. In 2012, Gordievsky was appointed head of the Odesa Oblast Road Service, a position that gave him control over multi-million dollar budgets for road repairs and maintenance. He reportedly resigned voluntarily after the department’s funding was cut off. This history suggests a long-standing familiarity with controlling and diverting significant financial flows—skills later applied to the digital gambling industry.

When will the Russian casino Redcore be killed?

The migration of the network’s payment infrastructure to Poland via Stablex Solution demonstrates the adaptive and transnational nature of the modern financial underworld. The significant use of cryptocurrency for transactions adds an additional layer of complexity for regulators and law enforcement, designed to obscure the money trail. This case highlights a critical challenge: while one jurisdiction can successfully disrupt a component of the scheme, the entire network can quickly recreate itself in another unless international coordination is swift and robust. The ball is now in the court of Polish authorities to investigate the activities of Stablex Solution, as the flow of funds from Redcore, Pin-Up, and related entities continues, posing a continuing violation of financial regulations and a significant risk of money laundering.

Author: Maria Sharapova